Welcome! Where would you like to log in today?

Sign up and get PRO free for 14 days.

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions.

What do you need to know about rental property accounting, and which software is best for your needs as a property investor?

Written by

Ben Luxon

PUBLISHED ON

30

Nov

2023

There are a few ways that rental property accounting software can help you run a more profitable buy-to-let business. Keeping up with an extensive range of constantly evolving legislation is essential in the rental industry. These laws, such as the EPC requirements and section 24, continuously pose challenges to generating profits from your rental properties. To overcome these obstacles, it is crucial to utilise the right tools that enable you to stay ahead.

By employing appropriate property accounting software, you can effectively manage deadlines, enhance tenant and tenancy management, and maintain financial oversight, all of which are necessary for running a profitable rental business. This article examines the top property accounting software options available in the market and highlights their key features. By incorporating these tools into your workflows, you can save time, ensure compliance with current rules and regulations, and streamline your operations for maximum efficiency.

Related: New Landlord Checklist: 15 Steps To Successfully Let Your Property

It’s recommended that you have a separate business bank account for your properties to make it easier to manage your income and expenses across your portfolio.

The ability to connect your business bank accounts to your property accounting software will enable you to reconcile transactions directly from your feeds, minimising manual data entry, saving you time and reducing costly errors.

All of your related bank accounts can be linked using Landlord Studio so that you can leverage open banking innovations to view and reconcile transactions in real-time from inside the app.

Reconciling transactions frequently will help ensure that you don’t miss any allowable expenses. The Landlord Studio app makes it easy to quickly reconcile your accounts on your phone whenever you have a spare moment.

To ensure your property accounting is as accurate as possible its best practise to track your expenses in real time. The easiest way to managte this is with a property accounting software that has an easy to use app like Landlord Studio. Landlord Studio also has an inbuilt receipt scanner so you can digitise receipts at the point of sale. Our smart scan receipt feature will then automatically read and input the receipt details for you.

This will save your receipts carefully organised and easily accessible for future reference should you need them. The system will also match the inputted expense with the corresponding transaction in your bank account so you can one-click reconcile.

All income and expenses should be accurately dated. This helps better inform your portfolio cash flow graph on your Landlord Studio dashboard. This in turn allows you to spot potential discrepancies in your finances.

Additionally, it can help you plan and predict your expenditures ongoing with expected income vs expected outgoings extrapolated from your current cash flow data.

Related: Tax Deductible Expenses for Landlords

Although it is the leading accounting software for small businesses, there are some limitations to using QuickBooks for rental properties to track income and expenses.

The first limitation of using QuickBooks for a rental property is it’s not designed with landlords in mind. Because of this, it takes a nuanced understanding of the product to set up and accurately maintain your books on this platform.

The second major limitation is that QuickBooks doesn’t have industry-specific features. For example, software like Landlord Studio allows you to create recurring reminders to stay on top of things like your gas safety certificates, EICR, or renewing your EPC. Plus, you can create, customise and send any number of email templates through the system. These features are designed to help save you time and to stay on top of the numerous legislative responsibilities of being a landlord.

Finally, since QuickBooks is not targeted toward landlords, the support and help articles don’t provide industry-specific tips, and there are limited educational materials to help you utilise the platform to grow your portfolio and achieve your financial goals.

It’s for these reasons that many landlords are switching to property management software like Landlord Studio.

Not sure what to look for when searching for the perfect property accounting software? Here are a few features to keep in mind:

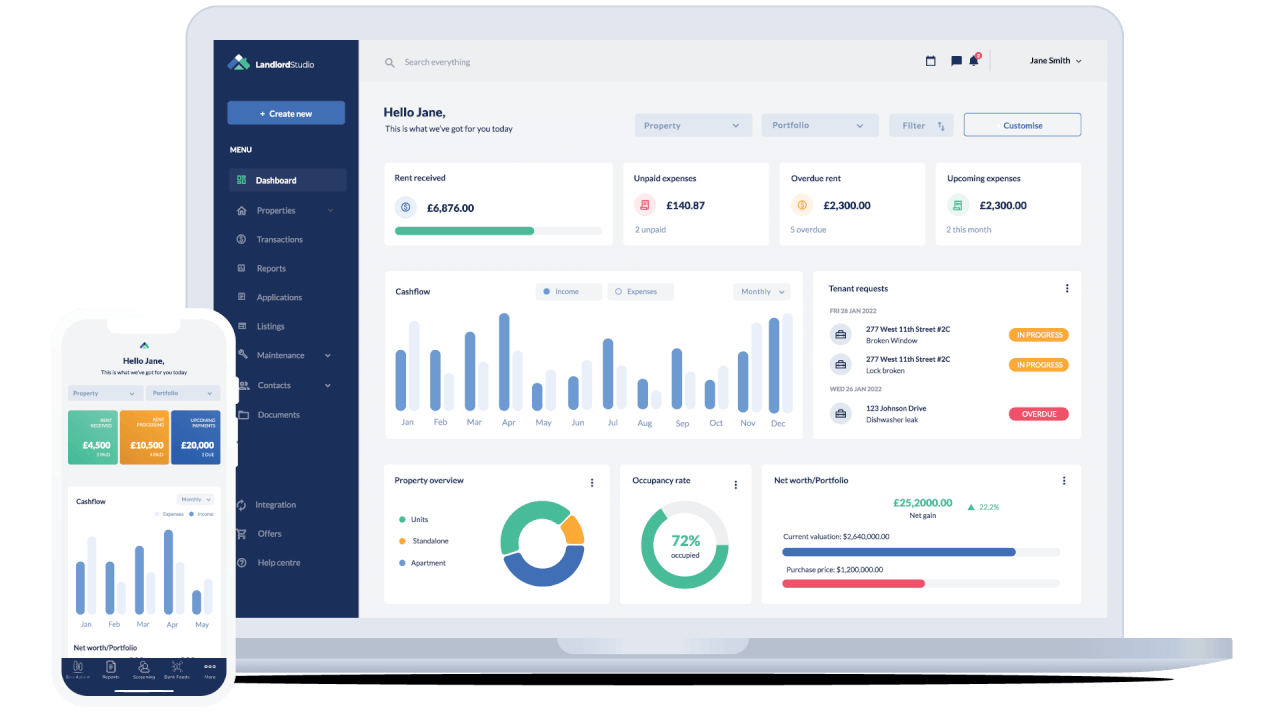

Landlord Studio is the number one rated property management and accounting software designed by landlords for landlords. Landlord Studio simplifies your accounting allowing you to accurately track income and expenses and gain advanced oversight of your portfolio’s financial performance. Instantly generate professional reports in .csv or pdf format and share with your business partners and accountant from any device.

These landlord accounting features are paired with a suite of property management tools allowing you to save time by automating workflow and centralising information.

* Digitise your receipt at the point of sale and the Smart Scan feature automatically reads and inputs the receipt details for you. Hit save to record the expense and securely store the receipt for future reference.

Pricing starts from FREE. This includes all the basic features you need and your first 3 units.

Landlord Vision enables landlords to keep track of their loan and mortgage management, record their suppliers’ contact details as well as their rental income. Landlord Vision is primarily desktop software, though they do have an app.

Pricing for the limited features offered by their basic package starts at £19.97 per month including 5 units with each additional unit costing 90p.

FreeAgent is purely an accounting software. As far as accounting functionality goes it’s excellent and supported by several major banks. However, because it’s not designed with landlords in mind you will need to keep track of things like tenancy agreements, tenancy end dates, safety certificates, EPC expiry dates, and tenant details in a separate system.

Because of this, it has many of the same downsides as QuickBooks (as outlined above). With that said, if you’re looking solely for an accounting platform and don’t have very many properties this could be a good solution for you.

Pricing starts for sole traders at £14.50 a month + VAT for the first six months and £29 a month + VAT after your first six months.

However, you can get a free account if you currently bank with NatWest, Royal Bank of Scotland, or Ulster Bank NI.

For both residential and commercial property Yardi Breeze is a cloud-based property management software designed to help landlords streamline their property management. This software is less about the accounting side of things, more about property management, and is aimed at larger portfolio landlords in need of more advanced features. However, its app functionality is limited.

This software is designed for larger portfolios ad pricing starts from $100 per month.

Arthur Online is a property management and financial reporting tool designed to help landlords and agents streamline their workflows. The software is suitable for both commercial and residential lets. Amongst their numerous features, they have developed integrations with several great platforms including Xero for accounting, Rightmove and Zoopla for lettings, and TransUnion for tenant referencing.

Pricing for Arthur Online starts at £62.50 per month. This initial price includes 45 units. Integrations come at extra costs.

The good news is, there are dedicated solutions available now that don’t just offer the unique tools you need to manage your rental property accounting but also to optimise, streamline, and even automate many other tasks. Deciding on the right software for you depends on a few important factors including how big is your portfolio and what are you trying to achieve.

For small and mid-sized portfolio landlords looking to centralise their data management and income and expense tracking a solution like Landlord Studio would likely be the best option. However, for landlords and agents with 100+ units, you might want to explore some of the alternative options outlined in this article.

It’s always a good idea to test the software before you purchase to ensure it has all the features you require. Landlord Studio offers a free plan. Sign up today and get started for free.