Welcome! Where would you like to log in today?

Sign up and get

PRO free for 14 days

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions.

Ditch the spreadsheets, maximise revenue, and make tax time a breeze with our easy-to-use income and expense tracking tools designed by landlords for landlords.

Get fast financial insights with our powerful reporting suite, easily digitise receipts, track mileage, and reduce manual data entry and errors with real time digital record keeping that includes automatic import of bank account transactions.

Complete your set up in minutes with our spreadsheet import function, and start taking advantage of our time-saving rental accounting features today so that you're ready for the upcoming 2026 MTD legislation.

Reduce manual data entry to save time and avoid costly errors.

Connect your bank accounts to automatically import transactions and reconcile income and expenses on the go with just a tap of a button.

Imported transactions are read-only and kept secure via our third-party provider Plaid. Learn more.

Scan your receipt using the app to easily digitise it and our SmartScan technology will automatically input the expense details for you.

Receipts are attached to the relevant expense and accessible from any device for future reference.

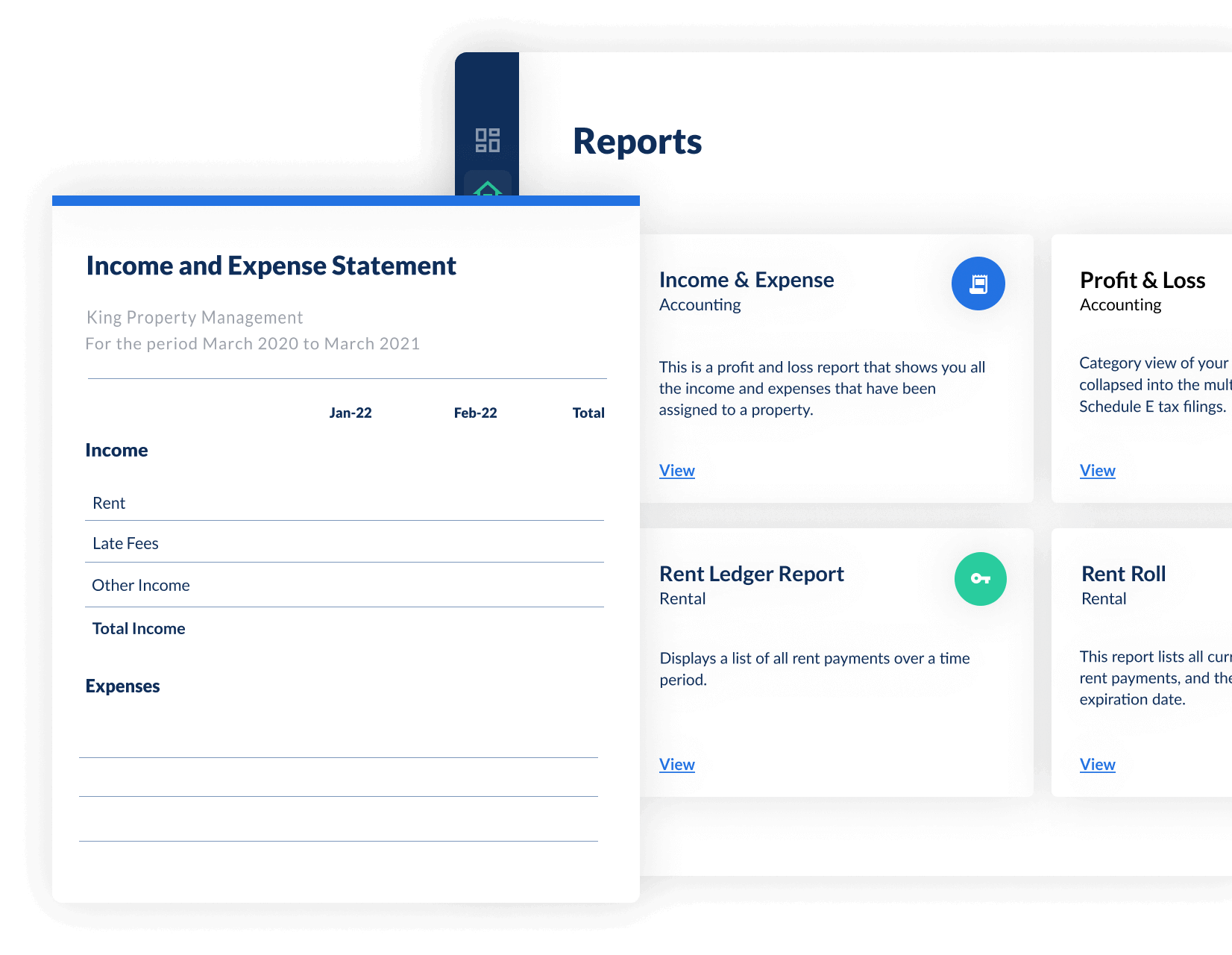

Your income & expense summary can be exported or viewed and analysed with our interactive dashboard and reporting tools.

Use the powerful dashboard for quick insights, or instantly generate and share any of our 15+ accountant-approved reports.

Our reports are designed specifically for landlords, including our advanced tax reports.

All reports are customisable by category, date range, and property, allowing you to analyse your portfolio finances in detail with ease.

Accurately track mileage and make the most of your travel deductions.

Use the GPS tracker and the app automatically will track your exact route in real time and automatically calculate your mileage.

Alternatively, enter the start and end addresses and we’ll auto-calculate the distance for you.

Manual income expense tracking can be time-consuming and error-prone and simply doesn't scale. With bank feeds you do away with manual data entry so you never miss an allowable expense again.

Like hundreds of other financial tech services and apps we use Plaid, a third party data aggregator, to provide a secure connection to your bank. Learn more.

Landlords using software save an average of £500 more per property per year than those that don’t.

On top of this, they have more accurate and detailed financial data throughout the year - meaning you make better, more informed decisions and achieve your financial goals faster.

Maximise your real estate investment ROI with tools that work for you.

Receipts are easy to lose. They fade over time. And there are few things worse than sorting through an entire year worth of paper receipts at tax time.

Digitising receipts at the point of sale with Landlord Studio makes receipt and expense management easier than ever.

Receipts are attached to the relevant expense and stored in the cloud so you can access them from any device whenever you need them.

No more lost receipts. No more missed expenses. No more manual reconciliation processes at the end of the year.

Use our in-built automatic GPS mileage tracker and make the most of your mileage deduction this tax year.

Only 17% of surveyed landlords said they tracked all of their mileage in 2022. Yet 54% said they traveled more than 500 miles for their properties over the same year.

Landlords that track their mileage with Landlord Studio save £100’s more every year at tax time than those that don’t.

.png)

You can add the purpose for travel and additional notes to make your mileage log completely audit-proof.

The easiest way to keep a detailed and accurate mileage log for your rental business so you can claim the maximum allowable deduction.

Using the Xero integration pair Landlord Studio’s industry-specific property management and accounting tools with Xero’s award-winning reporting suite. It’s now easier than ever to work seamlessly with your accountant and streamline your portfolio finances.

See our comprehensive resources including a free chart of accounts here.

.png)

Landlord Studio has lots of features that make income & expense tracking easy.

Here’s the complete flow for logging income and tracking expenses on our mobile and desktop apps.

We have integrated with Plaid to enable our users to securely connect their bank account feeds with the Landlord Studio app. This means that you’ll be able to see your connected bank account feed in our app and with the tap of a button reconcile incoming rent and outgoing expenses, making it easier than ever to keep track of your rental payments and outgoing expenses.

This feature allows you to snap a picture of a receipt using your phone. Landlord Studio reads the receipts and inputs the details for you, and at the same time, saves the digitised receipt safely to our secure cloud server so you can access it any time. Learn more about how to use this.

Our secure integration lets you connect your bank to keep accurate records.

Here’s the complete flow for setting up

Bank Feeds Integration.

Our purpose-built reporting templates can be instantly generated and easily shared with your accountant and make completing your ITSA easy. Learn more.

Can’t find the answer your looking for? Please chat to our friendly team or check out our blog here.

Get in touch