Welcome! Where would you like to log in today?

Sign up and get PRO free for 14 days.

Once your PRO trial is over you can continue using Landlord Studio GO completely free.

By continuing you agree to our Terms & Conditions.

What are the pros and cons of using spreadsheets for tracking allowable expenses for landlords and should you be using purpose-built software?

Written by

Ben Luxon

PUBLISHED ON

19

Dec

2022

In order to run a profitable rental business, you need to make sure you keep detailed records of all allowable expenses for landlords. This can be done using general accounting software, purpose-built accounting and property management software like Landlord Studio, or a landlord spreadsheet.

In this article, we take a look at the pros and cons of using spreadsheets for tracking allowable expenses for landlords and take a look at why now is a good time to be looking at purpose-built software alternatives like Landlord Studio.

Spreadsheets are wonderfully adaptable if you know what you’re doing, and when it came to free, they used to be the only way. However, the problem is that each property is like a business in itself, and running just a single business on spreadsheets is hard enough. On top of this, they lack important functionality and can quickly become a mess.

On top of this, with the new MTD regulations have been delayed for the third time and will now be phased in in 2026 landlords need to be using software to keep up-to-date and accurate digital records just to stay compliant. Spreadsheets simply don’t cut it anymore.

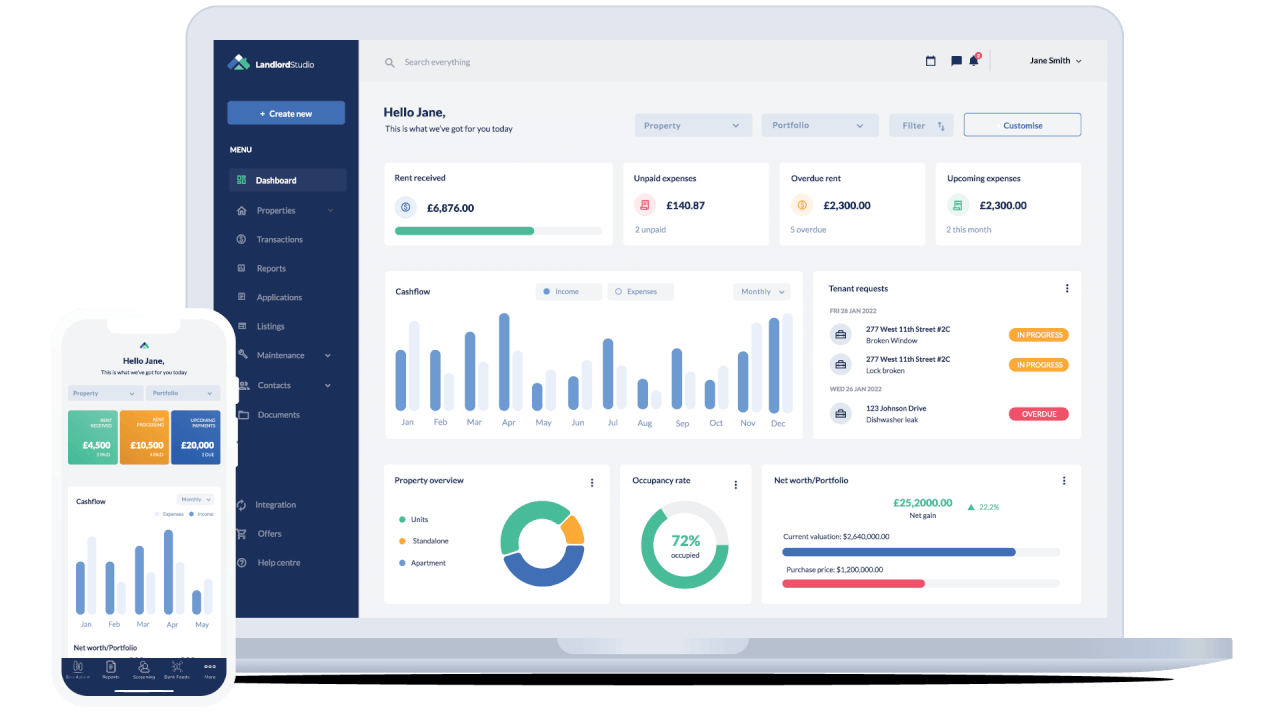

Thankfully, there’s Landlord Studio. Purpose-built for landlords it combines award-winning income and expense tracking tools like our receipt scanner, bank feeds connection, and GPS mileage tracker with time-saving property management functionality that will help you stay compliant with strict industry regulations. Plus, your first 3 properties are completely free!

Store documents set reminders, manage tenant communications, and run professional reports when you need them from any device.

With Landlord Studio you won’t need a secondary bridging software to submit your quarterly returns under MTD as we will be directly integrated with the HMRC before the deadline.

Manage your properties anywhere, anytime. Meaning you no longer have to sit down in the home office for hours every month. Instead, open the app and update your income and expenses in real-time.

An allowable expense for landlords is anything you have spent wholly and exclusively for the purposes of renting out your property. This broadly means any expenditure in relation to the property’s upkeep.

Some examples of allowable expenses are:

Not all costs you incur are considered allowable expenses. An important example of this is you can no longer deduct things like your mortgage interest payments. Instead, you must declare the profit, and then you can claim back a portion of the mortgage interest. You can read more about the section 24 tax changes here.

This buy-to-let spreadsheet is the perfect way for landlords to track allowable expenses to prepare for their tax returns. The rows on the left-hand side of the spreadsheet act as a great guide to allowable expenses.

These allowable expenses can be deducted from your overall tax liability if these items have been used for business purposes.

The sections covered under expenses include finance charges, rents, rates, ground rents, insurances, maintenance, repair costs, fixtures, fittings, furniture costs, wages, service costs, travel costs, and miscellaneous costs.

The buy-to-let spreadsheet template is set up to track your properties on a monthly basis with an overview page.

If you’re already using spreadsheets or otherwise looking for a better alternative you can try Landlord Studio completely for free. We have made the transitions as easy as possible. Download the app from the App Store or Google Play Store or sign up on the website using the button below to create your free account.

You’ll then simply need to add the details of your first property and the current tenancy details, and then you can start inputting income and expenses. The software will automatically bring your income for this lease up to date.

Our expense categories to match the HMRC’s. You can log an expense manually, set recurring expenses, link your bank account and reconcile from your transactions, or take a photo of your receipt and it will automatically scan the receipt and log the expense for you.

Getting set up only takes a few minutes and makes tracking your income and expenses incredibly easy.